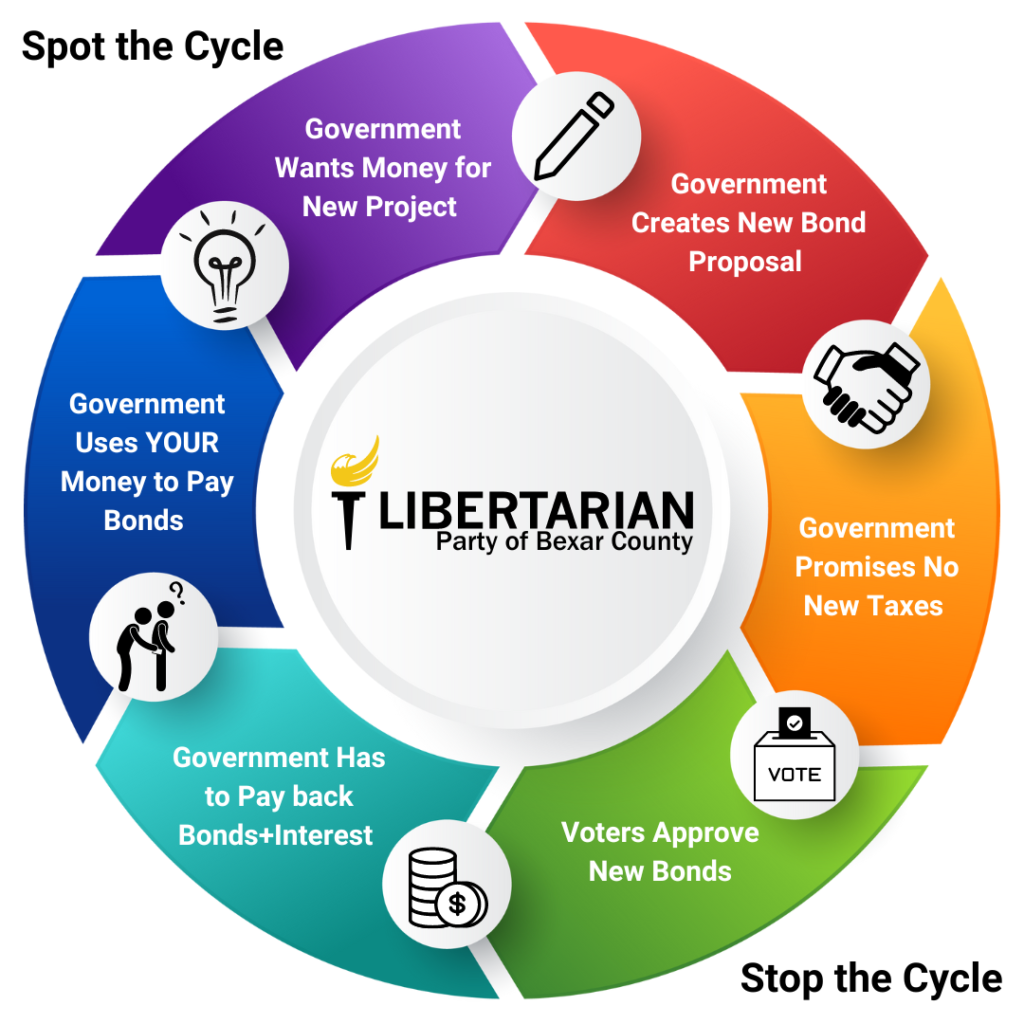

Municipal bonds, tax reauthorizations, and new taxes

Text: There are too many new bonds, tax reauthorizations, and new taxes to list off all of the text here but we wish to bring the following amendments to your attention.

CITY OF SAN ANTONIO – PROPOSITION A

CITY OF SAN ANTONIO – PROPOSITION B

CITY OF SAN ANTONIO – PROPOSITION C

CITY OF SAN ANTONIO – PROPOSITION D

CITY OF SAN ANTONIO – PROPOSITION E

CITY OF SAN ANTONIO – PROPOSITION F

HARLANDALE INDEPENDENT SCHOOL DISTRICT – PROPOSITION A

HARLANDALE INDEPENDENT SCHOOL DISTRICT – PROPOSITION B

HARLANDALE INDEPENDENT SCHOOL DISTRICT – PROPOSITION C

MEDINA VALLEY INDEPENDENT SCHOOL DISTRICT – PROPOSITION A

MEDINA VALLEY INDEPENDENT SCHOOL DISTRICT – PROPOSITION B

NORTHSIDE INDEPENDENT SCHOOL DISTRICT – PROPOSITION A

CITY OF GREY FOREST – PROPOSITION A

TOWN OF HOLLYWOOD PARK – PROPOSITION A

CITY OF LIVE OAK – PROPOSITION A

CITY OF OLMOS PARK – PROPOSITION NO. 1

CITY OF SHAVANO PARK – PROPOSITION A

CITY OF TERRELL HILLS – PROPOSITION A

CITY OF WINDCREST – PROPOSITION A

LPBexar suggests a “No” vote on all municipal bonds, tax reauthorizations, and new taxes. LPTexas Platform II.1.b and II.1.e

Proposition 1 (SJR 2)

Text: “The constitutional amendment authorizing the legislature to provide for the reduction of the amount of a limitation on the total amount of ad valorem taxes that may be imposed for general elementary and secondary public school purposes on the residence homestead of a person who is elderly or disabled to reflect any statutory reduction from the preceding tax year in the maximum compressed rate of the maintenance and operations taxes imposed for those purposes on the homestead.”

Impact: Proposition 1 would authorize the state legislature to reduce the property tax limit for school district property taxes imposed on the homesteads of elderly or disabled residents to reflect any tax rate reduction enacted by law from the preceding tax year. Specifically, in the prior tax year the legislature reduced the tax rate, but said reduction omitted the homesteads of elderly or disabled residents.

LPBexar Recommendation: LPBexar supports the elimination of all property taxes. Proposition 1 does move incrementally towards that goal by extending tax relief to persons forgotten by the duopoly. This is yet another reason that Libertarians advocate for universal tax relief, to prevent any person from being forgotten or left behind when the government picks winners and losers.

LPBexar suggests a “YES” vote on Proposition 1. LPTexas Platform II.1.b

Proposition 2 (SJR 2)

Text: “The constitutional amendment increasing the amount of the residence homestead exemption from ad valorem taxation for public school purposes from $25,000 to $40,000.”

Impact: Proposition 2 would increase the homestead exemption for school district property taxes from $25,000 to $40,000. This exemption was last increased in 2015 from $15,000 to $25,000 which would roughly equal $30,000 in today’s dollars when adjusted for inflation.

LPBexar Recommendation: LPBexar supports the elimination of all property taxes. Proposition 2 does move incrementally towards that goal, and provides important tax relief for homeowners struggling to keep up with inflation. Libertarians advocate expanding this important relief universally so that it may benefit renters as well as commercial and industrial property owners.

LPBexar suggests a “YES” vote on Proposition 2. LPTexas Platform II.1.b