LPBexar Voting Guide

Welcome to the Libertarian Party of Bexar County’s Voter Guide. On this page, you will find our position on ongoing legislation with a brief explanation of our position. Don’t forget to follow LPBexar on social media, subscribe to our newsletter, donate, and sign up to volunteer!

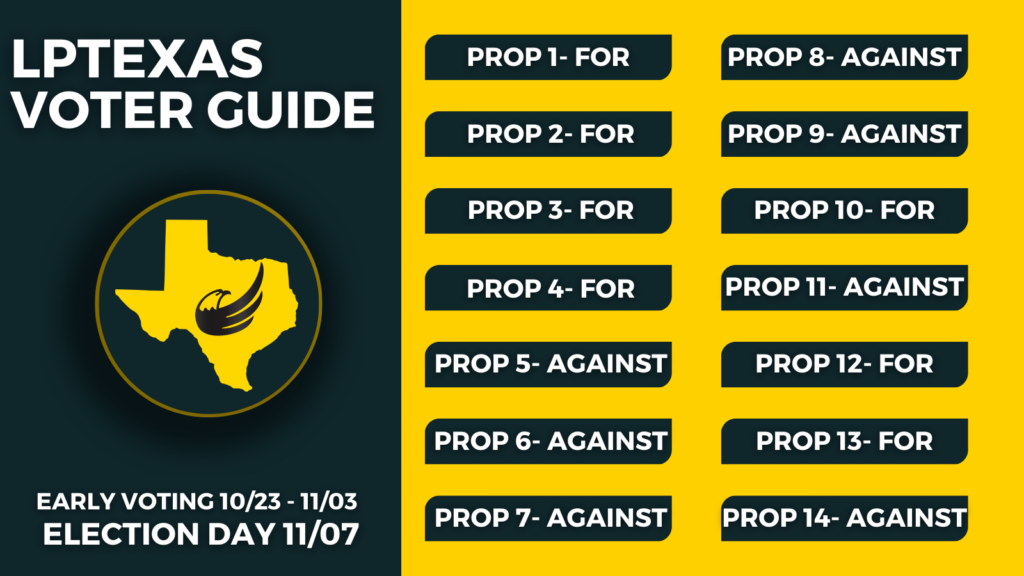

Proposition 1 – HJR 126

- Amendment: Protecting the right to engage in farming, ranching, timber production, horticulture, and wildlife management.

- Effect: Enumerates the right to agriculture. Does little to prevent regulation on a state level and from administrative agencies, but does limit some encroachment from municipalities by raising standard to be clear and convincing.

- Our Position: YES Platform I.2 “LPTexas stands firm with an individual’s inherent right to own property” (property rights include the right of enjoyment in one’s property – Jus in re propria)

Proposition 2 – SJR 64

- Amendment: Authorizing a local option exemption from ad valorem taxation by a county or municipality of all or part of the appraised value of real property used to operate a child-care facility.

- Effect: Would provide authority for the legislature to pass tax exemptions for child-care facilities. It would also allow the legislature to define a childcare facility for the purpose of the tax exemption.

- Our Position: YES Platform II.1.b “LPTexas supports the elimination of all property taxes” (While this would not eliminate all property taxes it is a step in the right direction, though there is debate that this amounts to picking winners and losers)

Proposition 3 – HJR 132

- Amendment: Prohibiting the imposition of an individual wealth or net worth tax, including a tax on the difference between the assets and liabilities of an individual or family.

- Effect: This is a ban on any hypothetical wealth tax and would prohibit the legislature from ever passing such a tax based on either wealth or net worth unless this amendment were repealed in the future.

- Our Position: YES Platform II.1 “LPTexas opposes the imposition of income tax by any governmental entity” (though not per se an income tax, a wealth tax serves an arguably analogous purpose targeting the fruits of one’s labor)

Proposition 4 – HJR 2

- Amendment: Increases the homestead tax exemption from $40,000 to $100,000

- Effect: Self explanatory, but again is limited only to homesteads, and places an appraisal cap on non-homesteads of 120%, allows legislature to use “tax compression” to offset school district collections

- Our Position: YES Platform II.1.b “LPTexas supports the elimination of all property taxes” (While this would not eliminate all property taxes it is a step in the right direction, though there is debate that this amounts to picking winners and losers)

Proposition 5 – HJR 3

- Amendment: Relating to the Texas University Fund, which provides funding to certain institutions of higher education to achieve national prominence as major research universities and drive the state economy.

- Effect: The money in NRUF comes from a state-owned fund that receives revenue from oil and gas royalties. The NRUF was created in 2009 to provide funding for research at universities aspiring to achieve national prominence. Texas State University, Texas Tech University, the University of Houston; and the University of North Texas are eligible beneficiaries.

- Our Position: NO Platform II.2.a “LPTexas seeks a nonpartisan education funding policy that would provide equitable use of state funds to eliminate waste and decrease bureaucracy, with the ultimate goal of voluntary funding.” (this new funding scheme furthers bureaucracy)

Proposition 6 – SJR 75

- Amendment: Creating the Texas water fund to assist in financing water projects in this state.

- Effect: The Water Fund would be money allocated by the legislature. Money appropriated by the legislature to the fund would be excluded from the appropriation limit. This fund would be used for water infrastructure projects throughout Texas.

- Our Position: NO Platform II.1.e “LPTexas supports a moratorium on … all other forms of government borrowing.” (Because this would bypass the appropriations limit, it could potentially lead to more government debt)

Proposition 7 – SJR 93

- Amendment: Providing for the creation of the Texas energy fund to support the construction maintenance modernization and operation of electric generating facilities.

- Effect: The Energy Fund would be money allocated by the legislature. Money appropriated by the legislature to the fund would be excluded from the appropriation limit. This fund could be used for loans to utility companies for dispatchable generation capacity.

- Our Position: NO Platform II.1.e “LPTexas supports a moratorium on … all other forms of government borrowing.” (Because this would bypass the appropriations limit, it could potentially lead to more government debt)

Proposition 8 – HJR 125

- Amendment: Creating the broadband infrastructure fund to expand high-speed broadband access and assist in the financing of connectivity projects.

- Effect: The Broadband Fund would be money allocated by the legislature. Money appropriated by the legislature to the fund would be excluded from the appropriation limit. This fund could be used for telecommunications projects in Texas.

- Our Position: NO Platform II.1.e “LPTexas supports a moratorium on … all other forms of government borrowing.” (Because this would bypass the appropriations limit, it could potentially lead to more government debt)

Proposition 9 – HJR 2 Regular Session

- Amendment: Provides a cost-of-living adjustment to certain annuitants of the Teacher Retirement System of Texas.

- Effect: Would allow the legislature through SB10 to provide a one time COLA adjustment that would come from the General fund and is estimated to cost $3.4B. The TRS was established in 1937 and is essentially social security for Texas educators.

- Our Position: NO Platform II.1 “The budgets of all levels of government must be balanced, and government spending reduced” (While our platform is silent on COLA adjustments to pre existing debt, this seems to go against fiscal restraint)

Proposition 10 – SJR 87

- Amendment: Authorize the legislature to exempt from ad valorem taxation equipment or inventory held by a manufacturer of medical or biomedical products to protect the Texas healthcare network and strengthen our medical supply chain.

- Effect: Enables legislation passed in SB 2289 which provides specific exemption carve outs for medical supplies as defined in SB 2289, and prohibits those from computation in any ad valorem tax scheme such as sales or property taxes.

- Our Position: YES Platform II.1 “All persons are entitled to the fruits of their labor” (While this does limit opportunities for taxation, the platform is silent on ad valorem taxes for consumption of goods. This amendment also picks winners and losers, and so we may want to abstain due to lack of authority from our platform)

Proposition 11 – SJR 32

- Amendment: Authorizing the legislature to permit conservation and reclamation districts in El Paso County to issue bonds supported by ad valorem taxes to fund the development and maintenance of parks and recreational facilities.

- Effect: This allows for government bonds to be issued and repaid from property taxes for the purpose of funding parks and rec in El Paso. Currently the constitution only allows this in Bexar, Bastrop, Waller, Travis, Williamson, Harris, Galveston, Brazoria, Fort Bend, Montgomery, and Tarrant county. This would amend the constitution to add El Paso to the list.

- Our Position: NO Platform II.1.e “LPTexas supports a moratorium on bond issuance, Certificates of Obligation, and all other forms of government borrowing” (This amendment specifically expands the power to issue debt and then potentially raise taxes to pay off the debt)

Proposition 12 – HJR 134

- Amendment: Providing for the abolition of the office of county treasurer in Galveston County.

- Effect: County treasurers are elected officials who merely distribute county funds at the direction of the county commissioner’s court, and have little discretion themselves. This would allow Galveston to delegate the duties of county treasurer.

- Our Position: YES Platform II.1 “We seek to reduce the size and scope of government.” (This eliminates one more elected bureaucrat reducing the size of gov’t, and provides clearer accountability for the county commissioners)

Proposition 13 – HJR 107

- Amendment: Increases the mandatory age of retirement for state justices and judges.

- Effect: Currently the age limit for state judges is 75, this would raise it to 79. It would also increase the minimum retirement age from 70 to 75.

- Our Position: YES Platform I.5.c “LPTexas supports the right of voters to decide who will be on the ballot.” (Ultimately the choice of candidate should belong to the voters)

Proposition 14 – SJR 74

- Amendment: Providing for the creation of the centennial parks conservation fund to be used for the creation and improvement of state parks.

- Effect: The Parks Fund would be money allocated by the legislature. Money appropriated by the legislature to the fund would be excluded from the appropriation limit. This fund could be used for State park projects in Texas.

- Our Position: NO Platform II.1.e “LPTexas supports a moratorium on … all other forms of government borrowing.” (Because this would bypass the appropriations limit, it could potentially lead to more government debt)